Find a home that

suits your lifestyle

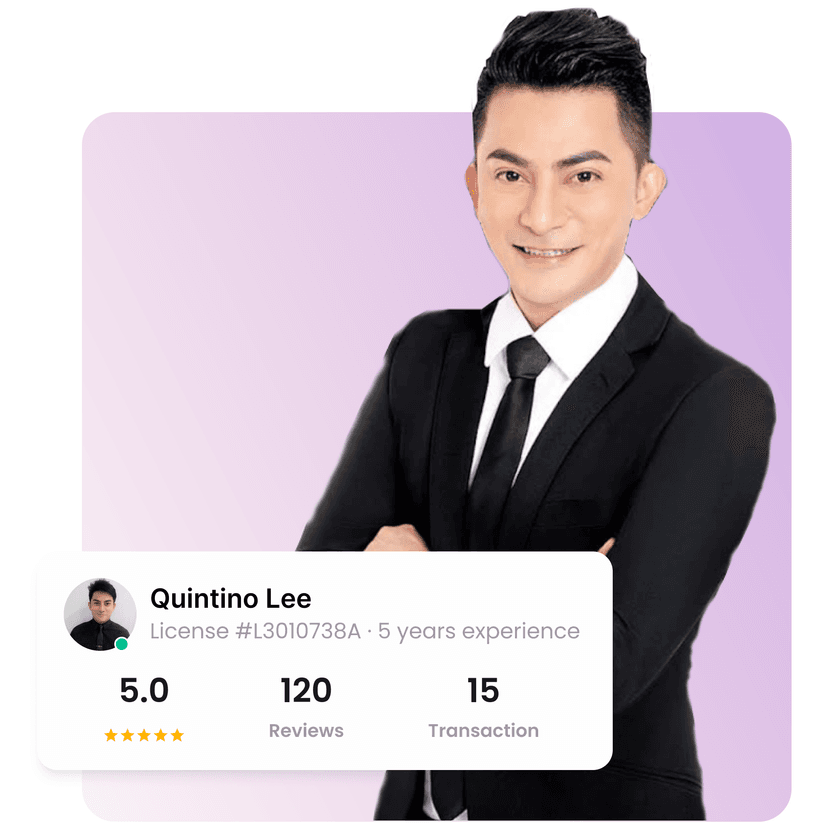

Make the easy move with SRI

Who you are in business

with matterspioneering real estate solutions

We deliver more value for you

HEAR FROM PAST CLIENTS

Join thousands of customers who made their move with SRI

Larry is a very professional and experienced real estate agent. He is very honest and straight forward in providing his valuable advice to me.

He chose to go the extra miles to assist me to coordinate with contractors to resolve new tenant's requests before handling over when i politely requested.

In short, I will not hesitate to recommend Larry to my family, friends, business partners and associates.

Nesh Ganesan & Maha Lakshmi's communication and negotiation skills were outstanding, ensuring a smooth transition.

I highly recommend them for their professionalism and commitment to delivering top-notch service for all!

It has been a pleasure working with Nick to sell our house. He is knowledgable, understanding and helpful.

Our family is very satisfied with Nick's attentiveness and competency shown through the entire sale process.

Thank you Nick!

I would like to extend my appreciation and thanks to your agent Garry Lew for handling my transactions.

He is definitely an asset to your company. His dedication and willingness to success is admirable

Appreciate Garry's great effort and meticulous planning for the sale and purchase of our new home!

I have always felt that i can never thank Maha and Ganesh enough. I was awestruck by their professionalism and thank you once again for helping me find a home.

Thanks to William's professional services, my partner and I were able to purchase our first home and are now living happily ever after.

William is proactive, warm, and reliable. He is always on the ball and provided timely updates during the same.

You can always trust him to get things done at any time of the day

I have a very pleasant experience dealing with Richard who listens well, communicates clearly, and pays great attention to details in all aspects, making the entire process from viewing to contract negotiation to handover smooth sailing and hassle free.

A Truly exemplary real estate professional!

Wayne works tirelessly for the needs of his clients and often uses data to help us make informed decisions. His service orientation and friendly disposition helped us to secure good offers for our home.

September 2024 GLS Tender Review: Tampines Street 94 & Media Circle Analysis

The September 2024 GLS (Government Land Sales) commentary outlines the tender results for two key sites: Tampines Street 94 and Media Circle. Tampines Street 94: This site, zoned for mixed-use residential and commercial development, attracted six bids. The top bid came from a joint venture between Hoi Hup Realty Pte Ltd and Sunway Developments Pte Ltd, offering $668.3 million (equivalent to $1,004 per square foot per plot ratio (psf ppr)). The second-highest bid by Sing Holdings Residential Pte. Ltd. was just 1.9% lower at $655.6 million ($985 psf ppr), highlighting competitive bidding despite a cautious market. The keen interest in this site demonstrates continued demand for strategically located mixed-use parcels, offering both residential and commercial potential. The proximity to amenities and the Tampines West MRT station enhances its appeal. Recent mixed-use projects, like J’den, which saw over 80% of units sold at launch, indicate strong market demand. The upcoming Executive Condominium (EC) at Tampines Street 95 is expected to further increase foot traffic and commercial viability for the development, making it an attractive proposition for developers and investors alike. The Tampines Street 94 development also benefits from its location within a residential area dense with HDB blocks, ensuring a ready customer base for its commercial offerings. Situated near educational institutions like Temasek Polytechnic, St. Hilda’s Secondary School, and others, the site is ideal for families. Given the market conditions, the expected launch price is projected to range between $2,200 to $2,300 psf, aligned with the Outside Central Region (OCR) median price of $2,107 psf as of Q2 2024. This site’s launch could be influenced by the earlier-launched Tampines Avenue 11 project, potentially setting price expectations for buyers. Media Circle: This site, located within the one-north Mediapolis precinct, was tendered for residential use (specifically for long-stay serviced apartments) with commercial space on the first storey. It attracted only one bid, submitted by Frasers Property in collaboration with Padawan MC Pte Ltd and Empire One North Property Pte Ltd, for $120.1 million ($461 psf ppr). Frasers Property, known for its experience in serviced apartments, sees potential in the site's strategic location, close to media and technology job hubs within the vibrant Mediapolis area. This contrasts sharply with the lack of interest in the Upper Thomson Road (Parcel A) site, which also included a serviced apartment component. The one-north area's connectivity and appeal to expatriates and professionals looking for convenience and proximity to work explain the interest in Media Circle. Rental demand in the Queenstown planning area, where Media Circle is located, has grown significantly, with rental contracts increasing from 1,340 in the first half of 2023 to 2,024 in the first half of 2024, further validating the attractiveness of this location for long-term rentals. This report concludes by emphasizing that while the information presented is based on available data, real estate investment decisions should be approached with professional advice, as market conditions and regulatory factors can shift.

August 2024 Developer Sales: OCR Shines Despite Hungry Ghost Festival Dip

In August 2024, developers sold a total of 208 units, excluding Executive Condominiums (ECs), marking a significant month-on-month decline of 63.6% from July's 571 units. This drop in sales aligns with the Hungry Ghost Festival, a period traditionally associated with reduced home-buying activity due to cultural beliefs. The sales volume during this month was the lowest since February 2024, when only 153 units were sold during the Chinese New Year period. Year-on-year, new home sales in August 2024 reflected a 47.2% drop from the 394 units sold in August 2023. Despite the overall decline, the Outside Central Region (OCR) remained a bright spot, contributing 59.1% of the total sales. Projects such as Hillock Green, Lentor Hills Residences, and Hillhaven were among the key contributors. The Rest of Central Region (RCR) accounted for 31.3% of sales, while the Core Central Region (CCR) made up 9.6%. The OCR's continued strong performance highlights the demand for more affordable housing in non-central locations, attracting a mix of first-time homeowners and upgraders. Tembusu Grand, located in the RCR, led the sales in August with 30 units sold at a median price of $2,455 per square foot (psf). Its strong performance was supported by the upcoming launch of Emerald of Katong, which boosted the neighborhood's profile. Enhanced connectivity due to new Thomson-East Coast Line stations further improved the attractiveness of the area. The luxury property market, despite the broader market moderation, demonstrated resilience. The most notable transaction in August was a $14.7 million sale at 32 Gilstead, which was also the highest transacted freehold condominium in the first eight months of 2024. This transaction underscored the continued demand for prime properties among high-net-worth individuals, even during typically quieter periods. Looking ahead, the market is expected to likely rebound with the conclusion of the Hungry Ghost Festival and several new project launches. Developers are strategically timing these launches to capture demand, and upcoming projects like 8@BT, Norwood Grand, and Meyer Blue are poised to drive interest. Additionally, a potential Federal Reserve rate cut could further ease global interest rates, including those in Singapore, potentially boosting buyer sentiment and market activity. In conclusion, while August 2024 saw a slowdown in developer sales due to seasonal factors, the OCR and luxury property segments remained resilient. Upcoming launches and favourable economic conditions are expected to bolster the market in the coming months.

1H2024 Singapore Rental Market Insights: School Proximity and Pricing Trends

The rental property market in Singapore during the second quarter of 2024 demonstrated notable trends and adjustments. The overall rental index showed a further moderation, with rental prices decreasing by 0.8% in 2Q2024, a smaller decline compared to the 1.9% drop in 1Q2024. This period also marked a stabilization in the market as rental prices in the first half of 2024 adjusted by -2.7%, a significant change from the 10.2% increase observed in the first half of 2023. The moderation can be attributed to the influx of newly completed developments entering the market, adding to the rental supply. The number of non-landed rental contracts rose by 1.9% quarter-on-quarter, from 18,878 units in 1Q2024 to 19,558 units in 2Q2024. This increase is likely driven by the high volume of private developments completed in 2023, which have now entered the rental segment. The year-on-year growth of non-landed rental contracts in 1H2024 was 2.4%, reflecting continued demand for such properties. It is projected that the total non-landed rental volume for 2024 will fall between 78,000 and 80,000 contracts. Newly completed developments, particularly those that obtained their Temporary Occupation Permit (TOP) recently, such as Normanton Park, Treasure at Tampines, Parc Clematis, and The M, have shown strong rental demand. Renters seem to favor newer units due to their fresh condition and minimal wear and tear. Core Central Region (CCR) districts continued to lead in rental popularity, with District 9 securing the highest number of non-landed rental contracts in 1H2024, followed by Districts 10 and 15. These districts remain desirable among renters, underlining their prominence in the rental market. The HDB rental market also experienced growth, with rental approvals increasing by 1.7% quarter-on-quarter from 9,398 in 1Q2024 to 9,554 in 2Q2024. A significant portion of these approvals (36.9%) were for 4-room flats, which saw the highest number of rental approvals since 3Q2023. Jurong West recorded the highest number of HDB rental transactions in 1H2024, followed by Tampines and Sengkang. Despite the overall moderation in HDB rentals, the resale market strengthened in 1H2024, with a 6.9% increase in resale transactions compared to 1H2023. This trend indicates a shift towards resale flats among homeowners, partly due to the limited number of flats reaching their Minimum Occupation Period (MOP) in 2024. School proximity significantly influenced rental growth in areas like Bukit Batok and Hougang, where highly sought-after schools like Princess Elizabeth Primary School and Holy Innocents' Primary School are located. The scarcity of larger flats and the high demand for school enrollment contributed to notable increases in rental prices in these areas. Overall, the rental market in Singapore is stabilizing, supported by strategic housing initiatives from the government. These initiatives aim to alleviate rental pressures by boosting housing supply and providing targeted support for those in need, ensuring a balanced and accessible rental market for residents.

CEA License No. L3010738A

1 Kim Seng Promenade #17-10/12

Great World City, West Tower

Singapore 237994

For Home Owners

For Corporate

© 2023 SRI Pte Ltd • Privacy Policy & Data Protection